Payroll Adjustments

| Date Created | May 22, 2023 |

|---|---|

| Process Name | Payroll Adjustments and Corrections |

| Version Number | B |

| Procedure Number | 0008 |

| Process Owner | University Budget and Resource Planning |

| Date of Last Update | February 12, 2025 |

| Purpose | Submit information to adjust an employee’s previously posted payroll. |

|---|---|

| Scope | Scope of this document pertains to Sonoma State University's version of Data Warehouse and HRS. |

| Document Management | University Budget and Resource Planning retains all copies of Business Process Guides and handles distribution. |

| Roles and Responsibilities | University Budget and Resource Planning retains responsibility for the accuracy of the information within Questica Budgeting software. |

Process

STEP

SCREENSHOT

1. Navigate to the LCD Dashboard in Data Warehouse

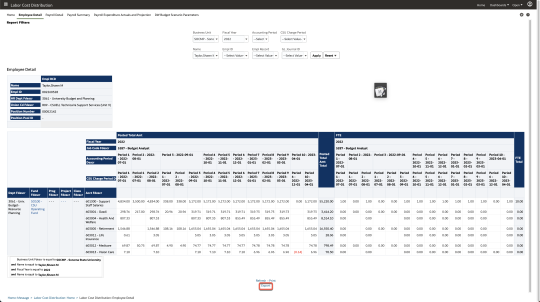

2. Navigate to Employee Detail

3. Fill out the following fields:

Business unit =”SOCMP”

Fiscal Year = Current year

Accounting period = leave blank

CSU Charge Period = leave blank

Name = Name of Employee

Empl ID = Employee ID

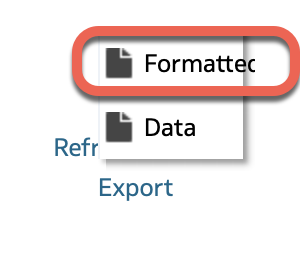

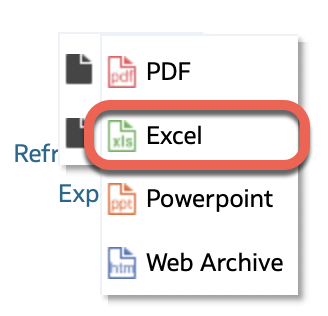

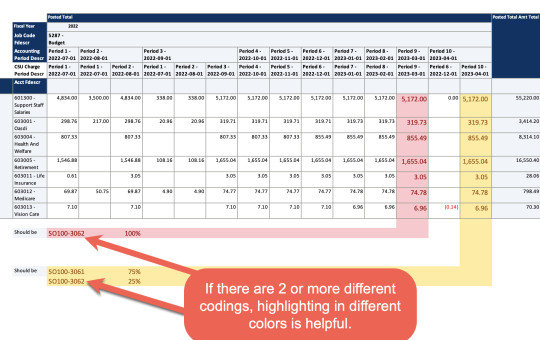

4. Verify information on screen. If the information is correct, export the formatted Excel version.

5. Open the file in Excel and highlight values that need to be adjusted.

6. Indicate on the sheet where the payroll should be reclassed. If wages need to be split between different chartstrings, indicate all chartstrings and their respective percentages.

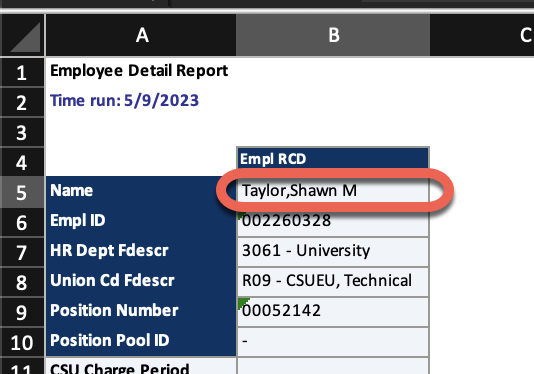

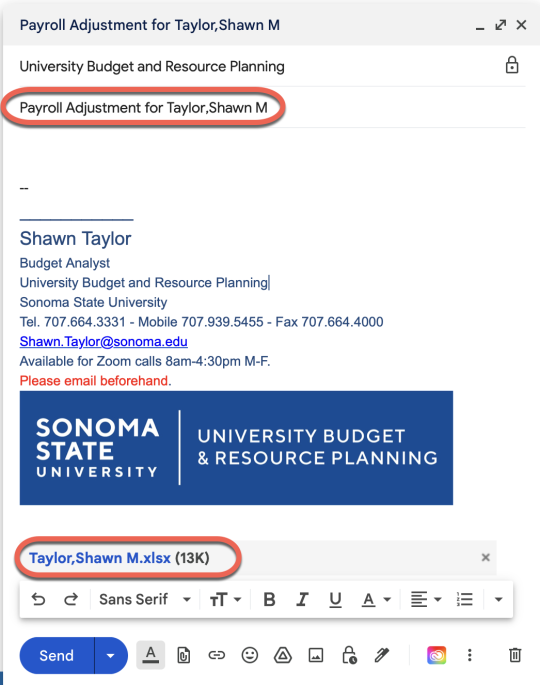

7. Save file with employee name from cell B5. Example: “Taylor, Shawn M”

8. Send email to [email protected] with a subject “Payroll Adjustment for ‘employee name from B5’ and attach the Excel file.

9. We suggest that you check Data Warehouse (Financial Reporting or Labor Cost Distribution) to verify that the correction was posted and done correctly within a few days.

| Version | B |

|---|---|

| Date of Revision | February 12, 2025 |

| Description of Change Implemented | Updated process |

| Completed by | University Budget and Resource Planning |